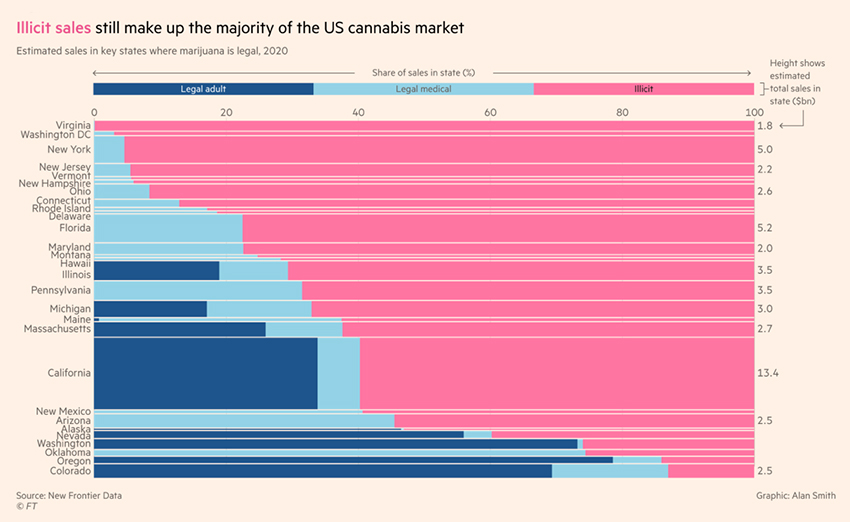

Despite the relaxation of possession and sale laws at the state level, illicit sales, evading taxation and regulation, has the biggest market share. Why might that be?

There are two compelling reasons. First, given the federal laws, legal marijuana sales, both recreational and medicinal, have not been able to make use of our banking system. They are all-cash businesses and spend a good deal of time counting cash to pay their ongoing expenses. More importantly, they cannot get loans to grow their retail business. This has not deterred private equity investment, but you need to be big; they are not small business loans. Of course, there are other legitimate and not loan opportunities, but they come at high-interest rates – the vig (actually vigorish) can be the same as credit card charges, 20%. The result is that the cost of doing retail business is high (no pun intended), which raises the product's price.

The second reason is entangled with the first, and it is price. Wholesale prices have been dropping because of overproduction. What is grown in Hawaii or California stays there; federal law prevents the transportation of a Schedule 1 drug across state lines. So there are disparities in production and legal distribution. Wholesale prices range from $1 to $7 a gram with a retail price of $18. But a significant part of that markup is state and local taxes; in California, there is a baseline tax of 15% and a variable local tax of up to 40%. The net result illegal sales can undercut legal prices and still turn a significant profit. California’s estimated $4.5 billion in legal sales is roughly half their $8 billion in illicit sales. Finding the right tax rate that increases the state’s coffers without giving advantage to illegal sales is problematic; Colorado and Oregon seemed to have found a sweeter spot than many other states.

Source: Banking on cannabis: the new network of lenders for a semi-legal industry